Why work with a finance broker?

When it comes to business funding, choice can be overwhelming. That’s where a finance broker steps in—not just to save you time, but to enable you to make informed decisions.

Smarter applications. Faster approvals.

We understand exactly what lenders are looking for. With deep knowledge of approval criteria across financial institutions, we tailor your application to the right lenders—improving your chances of approval, and speeding up the process.

More options. Better deals.

Rather than limiting you to one lender, we compare multiple finance products, interest rates, and repayment plans to find the most suitable option for your needs. Our aim? To secure the right deal—not just a deal.

Trusted by lenders. Working for you.

Lenders value brokers because we bring them viable, well-prepared applications. You benefit because we handle the complexity, negotiate on your behalf, and act in your best interest at every step.

Save time. Save money.

Arranging business finance can be a full-time job. We do the heavy lifting—analysing your options, dealing with lenders, and handling the paperwork—so you can focus on running your business.

A relationship that grows with you.

We work consultatively, not transactionally. As your business grows, we stay in touch, adjusting your financing strategy and supporting you long-term—not just once, but every time you need funding.

One place. Unlimited solutions.

With access to a wide panel of lenders and flexible finance options, we offer a powerful, all-in-one route to business funding—designed around you.

Ready to secure the right finance?

Let’s talk. We’ll help you find a solution that fits your goals today—and supports your growth tomorrow.

BOOK A CALLMaximise ROI. Improve cashflow.

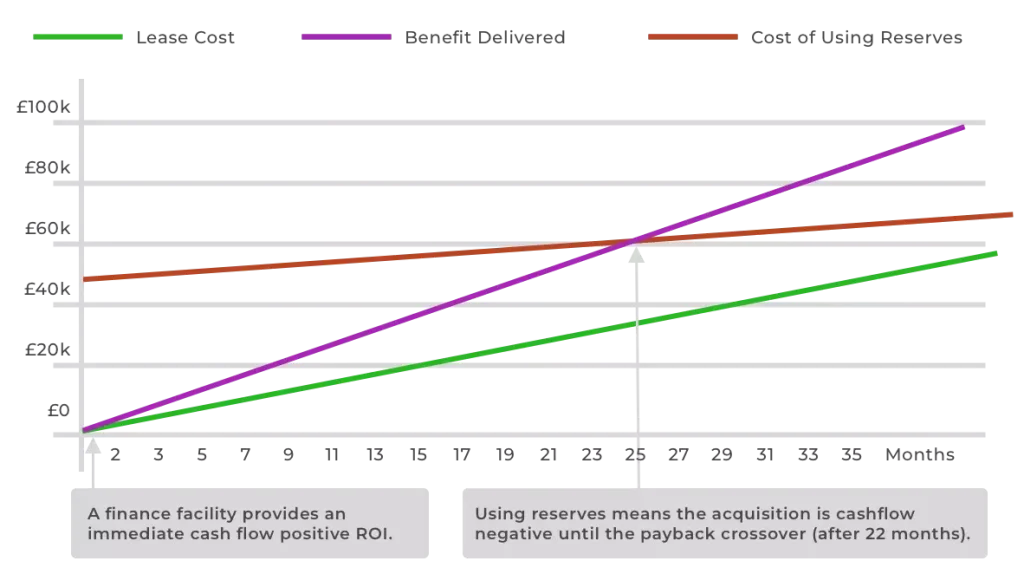

Financing an asset doesn’t just spread the cost—it can supercharge your return on investment.

Let’s say you buy an asset worth £50,000:

It delivers £2,750 per month in value.

The finance cost is just £1,639 per month.

That’s a £1,111 per month positive cashflow—from day one.

Use cash reserves, and it takes nearly 2 years just to break even.

Financing makes your capital work harder.

Considering an investment?

Lets work together to cost, justify and assess viability of the acquisition. Additionally an "in

principle" facility can be established prior to engaging with suppliers allowing you to negotiate knowing funds are in place and get the best deal.

Why Choose Powerhouse?

Client relationships

After decades of working with all types and sizes of busnesses, the challenges

you face are understood and will advise you every step of the way.

Market experience

With a vast network of funders available, you'll receive tailored finance options.

Delivering success

Enjoy freedom and grow your business with the right financial backing.

Join a Community of Successful Clients

Hear from businesses like yours who have thrived with support from Powerhouse.

Ready to take the next step?

Contact Powerhouse today to explore how we can help your business reach new heights.

Powerhouse Business Finance Limited is an independent asset finance brokerage not a lender, as such we can introduce you to a wide range of finance providers depending on your requirements and circumstances. We are not independent financial advisors and so are unable to provide you with independent financial advice. Powerhouse Business Finance Limited will receive payment(s) in the form of commission from the finance provider if you decide to enter into an agreement with them. We work with both discretionary and non-discretionary commission models. Commission payments are factored into the interest rate you pay.

Powerhouse Business Finance Limited is an Appointed Representative of AFS Compliance Limited which is Authorised and Regulated by the Financial Conduct Authority FRN: 625035

Powerhouse Business Finance Limited aims to provide our customers with the highest standards of service. If our service fails to meet your requirements and you would like to report a complaint; please click on the link below:

Complaints Procedure