Add finance to your offering. Unlock more sales.

Offering finance as part of your sales process gives your customers greater flexibility—and gives you a powerful competitive edge. With Powerhouse Business Finance as your partner, it’s simple, effective, and fully managed.

Lower cost of entry. Higher conversion.

A small initial deposit is easier to commit to than a large upfront capital cost. This reduces budget resistance and opens the door to more conversations—and more deals.

Stronger business case. Immediate ROI.

Monthly payments help your customers demonstrate instant return on investment. Instead of waiting months for approval, your solution starts delivering value from day one.

Maximise ROI. Improve cashflow.

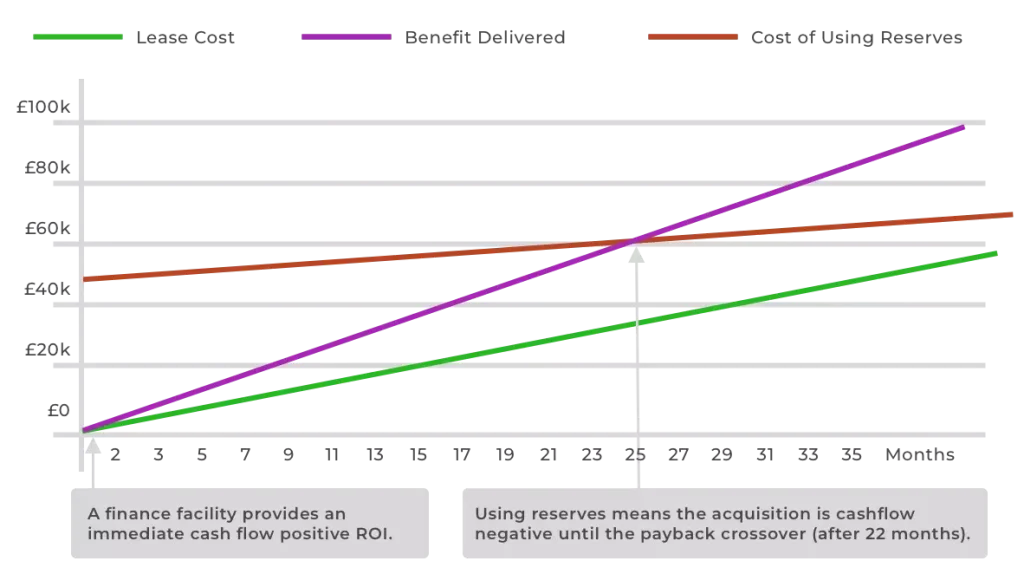

Financing an asset doesn’t just spread the cost—it can supercharge your return on investment.

Let’s say you buy an asset worth £50,000:

It delivers £2,750 per month in value.

The finance cost is just £1,639 per month.

That’s a £1,111 per month positive cashflow—from day one.

Use cash reserves, and it takes nearly 2 years just to break even.

Financing makes your capital work harder.

Equip your sales team.

It is essential that suppliers equip their salespeople to introduce payment-over-time / finance arrangements early in the sales cycle — ideally during the evaluation and assessment stage when the influencer is engaged.

Doing so means the influencer can take a fully costed proposal, including finance options, to the authoriser.

When finance is built into the proposal early, the authoriser sees both the operational benefit and the financial viability at the same time.

This alignment shortens the cycle from quotation to order and reduces the risk of stalled deals.

Fewer stalled deals. Faster decisions.

When your buyer needs to convince a finance approver, we help arm them with a compelling business case. That means fewer bottlenecks in procurement—and more momentum in the sales process.

Total solution. Zero friction.

Finance can cover deposits, staged payments, installation, configuration, training, maintenance—you name it. You stay in control of contractual terms while giving customers more flexibility.

Accelerated revenue recognition.

Instead of spreading revenue across a contract term (like with ASP models), finance allows you to recognise full revenue up front, improving cashflow and reducing debtor days.

Bigger orders. Easier to sell.

Increasing capital spend can be hard. But a small increase in monthly operating cost? That’s often a far easier sell—leading to higher average order values and upsell potential.

Stand out from competitors.

Offering finance as standard positions you as proactive, solution-led, and commercially savvy. It’s an easy differentiator in competitive tenders or crowded markets.

Shorter sales cycles.

When finance is built in from the start, pricing objections are addressed early—so your deals move quicker, and your pipeline gets smoother.

Powerhouse handles everything.

From initial quote to payout,

Powerhouse works alongside your sales team to:

Tailor financial packages for each customer

Collect required info directly from the client

Manage credit approval, contracts, and invoicing

No added admin. Just smoother sales.

Want to offer finance to your customers?

Let’s find out how to turn funding into a sales asset.

PARTNER WITH USJoin a Community of Successful Clients

Hear from businesses like yours who have thrived with support from Powerhouse.

Ready to take the next step?

Contact Powerhouse today to explore how we can help your business reach new heights.

Powerhouse Business Finance Limited is an independent asset finance brokerage not a lender, as such we can introduce you to a wide range of finance providers depending on your requirements and circumstances. We are not independent financial advisors and so are unable to provide you with independent financial advice. Powerhouse Business Finance Limited will receive payment(s) in the form of commission from the finance provider if you decide to enter into an agreement with them. We work with both discretionary and non-discretionary commission models. Commission payments are factored into the interest rate you pay.

Powerhouse Business Finance Limited is an Appointed Representative of AFS Compliance Limited which is Authorised and Regulated by the Financial Conduct Authority FRN: 625035

Powerhouse Business Finance Limited aims to provide our customers with the highest standards of service. If our service fails to meet your requirements and you would like to report a complaint; please click on the link below:

Complaints Procedure